That is followed by today's television roadshow by Ackman himself, in what appears to be a further minimization of the potential ramifications of such an investigation. Pershing's release also completely sidesteps the fact that Pershing's agents were in fact subpoenaed, including the agency that lobbied Senator Markey to write his now infamous three letters to Herbalife, the FTC and the SEC.

GSG is confident they are not the target of the Federal investigation and if it really isn't GSG, that leads you in two directions: up the flag pole or down the flag pole. Sure, maybe they're targeting one of the subcontractors involved for wiretapping, pretexting or something like that, but it's probably more likely they're going after the bigger fish with the gilded gills. It's entirely possible they're going after a subcontractor in connection with all the bugs found in Herbalife's corporate offices, but the journal specifically calls out the phrase "market manipulation," not illegal wiretapping.

Ackman's response today is very interesting too. Today he repeatedly said that he hasn't traded around his Herbalife short. What exactly does it mean to say that you "haven't traded around the Herbalife short" anyway? Aside from showing off a nonpublic letter on his iPhone from Representative Sanchez to his dinner compatriots, or hosting a nonpublic letter from Adriano Espaillat on his website, or the two different versions of the Senator Markey letter (cc: @copieratpershingsquare) or the grossly inaccurate disclaimer on Pershing Square's anti-Herbalife website, and all the necessary actions and trades it would have required to build/restructure a position around, and concurrently with these events, I'm not really sure what he could be talking about. He certainly can't mean that he isn't trading the Herbalife position now can he? Not surprisingly, it appears he is. Clearly the position size is shrinking in terms of AUM and exposure on the position. How could this be???

"What we've done since then is simply rolled those puts and kept on approximately the same size investment."

As of February 28th, that position was -5% of his exposure with $19.9B AUM. Back in November when the AUM was $900M smaller, his exposure was also at -5%.

Herbalife closed at $43.25 at the end of November and closed February at $31.01 (a 28% decline). For Pershing's performance reports to be true and accurate, his Herbalife position had to have been between 21.8M-24.0M shares at the end of November(or $943-$1,036M in value). Assuming that he didn't trade around the position in that period as he claims, his exposure on HLF would have grown by $267M-$293M. The increase in value associated with the decline in the stock would have put his exposure on the position at a minimum of 6.1% and maximum of 6.7% at the end of February. That leaves two options for our dear amigo: Pershing's performance statements are inaccurate, or Ackman's statements about not trading around the stock are inaccurate.

The strokes he uses to describe the interactions with the Fed have a much finer point though. Ackman has seemingly been very careful to draw a clear line that the Feds haven't contacted him regarding market manipulation or misconduct with respect to Herbalife. That turn of phrase has turned up time and again in his TV onslaught today.

Makes me wonder if they have contacted him regarding manipulation or misconduct with respect to Pershing's Allergan, Valeant or Actavis investments. It was very recently that Pershing announced that they had a major position in Valeant as well as disclosing in court filings last week that Valeant was still a member in PS Fund 1, which is controlled by Pershing. Weird, amiright?

The WSJ article also mentions that the Feds opened their investigation into allegations about both Herbalife and Pershing Square, but that the investigation shifted focus to market manipulation this year. Maybe it didn't take too much effort for the Feds to figure out there wasn't too much meat on the Herbalife bones and focus their attention elsewhere.

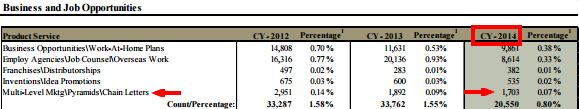

I can't help but wonder if I were the Feds who's leg I'd gnaw on? Would I be going after a company like Herbalife or Ackman/Pershing Square? You don't have to dig too far to determine the Herbalife bone, is pretty thin (aside from the constant exercise, there isn't a lot to the complaints in my opinion). For instance, the FTC's Consumer Sentinel Network report recently released ALL complaints in its entire reporting structure directed against multi-level marketing at 1,703 total complaints in 2014(0.07% of all complaints filed). Even IF (and this is a big if) you assume that every last one was a legitimate complaint specifically against Herbalife, that would represent 0.3% of Herbalife's total US distributor/member base. Aside from the fact the Connecticut Attorney General did not identify a single organic complaint that was valid, or that much of the froth in Illinois is based on Pershing's local LULAC affiliations with Julie Contreras, or that we are also recently instructed by the class action suit against Herbalife in which not one single objection to the proposed class action settlement has been filed. Not ONE. If Herbalife was as terrible and ruthless as Ackman claims, why aren't there any real complaints out of the millions of people represented by the class? There is also an awesome little easter egg hidden in Thomas Foley's March 10th declaration in that case. After discussing the fact that no objections had been filed, Mr Foley, whom is the attorney fighting against Herbalife said:

I can't help but wonder if I were the Feds who's leg I'd gnaw on? Would I be going after a company like Herbalife or Ackman/Pershing Square? You don't have to dig too far to determine the Herbalife bone, is pretty thin (aside from the constant exercise, there isn't a lot to the complaints in my opinion). For instance, the FTC's Consumer Sentinel Network report recently released ALL complaints in its entire reporting structure directed against multi-level marketing at 1,703 total complaints in 2014(0.07% of all complaints filed). Even IF (and this is a big if) you assume that every last one was a legitimate complaint specifically against Herbalife, that would represent 0.3% of Herbalife's total US distributor/member base. Aside from the fact the Connecticut Attorney General did not identify a single organic complaint that was valid, or that much of the froth in Illinois is based on Pershing's local LULAC affiliations with Julie Contreras, or that we are also recently instructed by the class action suit against Herbalife in which not one single objection to the proposed class action settlement has been filed. Not ONE. If Herbalife was as terrible and ruthless as Ackman claims, why aren't there any real complaints out of the millions of people represented by the class? There is also an awesome little easter egg hidden in Thomas Foley's March 10th declaration in that case. After discussing the fact that no objections had been filed, Mr Foley, whom is the attorney fighting against Herbalife said:"I anticipate that objections to the proposed settlement will be filed by attorneys affiliated with, and potentially funded by, the short sellers."Sure it's entirely possible the Feds could be targeting Herbalife, or they could be targeting one of the little fishes hired by Global Strategy Group, but then again, on the heels of Fannie Mae, Allergan, Valeant, Actavis and Herbalife, if you were Mr. Bharara wouldn't you be targeting somebody with $19B in AUM that you'd already deposed? It's probably true that Ackman hasn't been subpoenaed or visited by the FBI, the real question is: how long will that remain to be true?

Ackman has played fast and free with the truth from the very beginning. Walking that fine line of illegality, the same line he calls Herbalife out on. The hypocrisy of his position is disgusting.

ReplyDelete